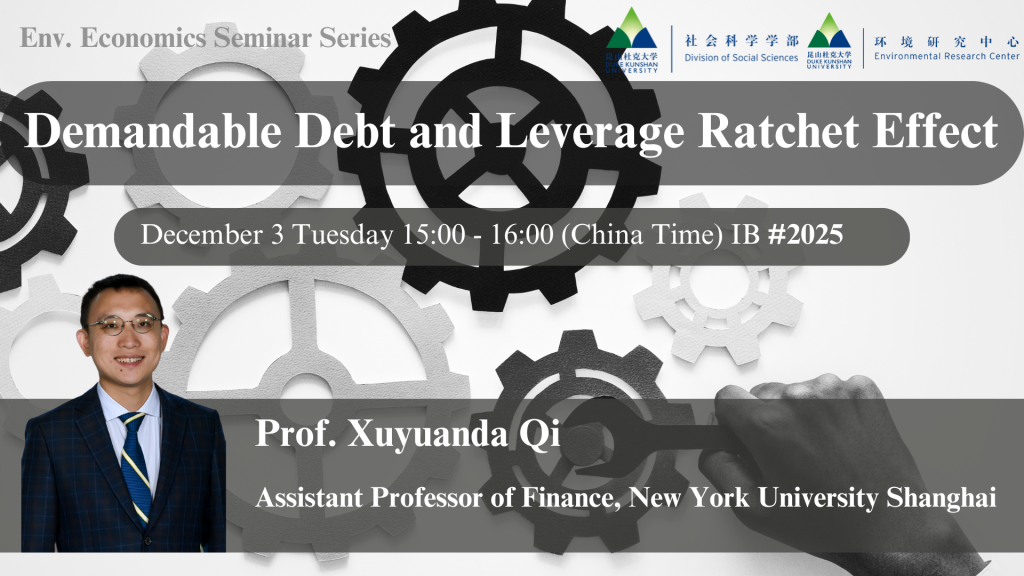

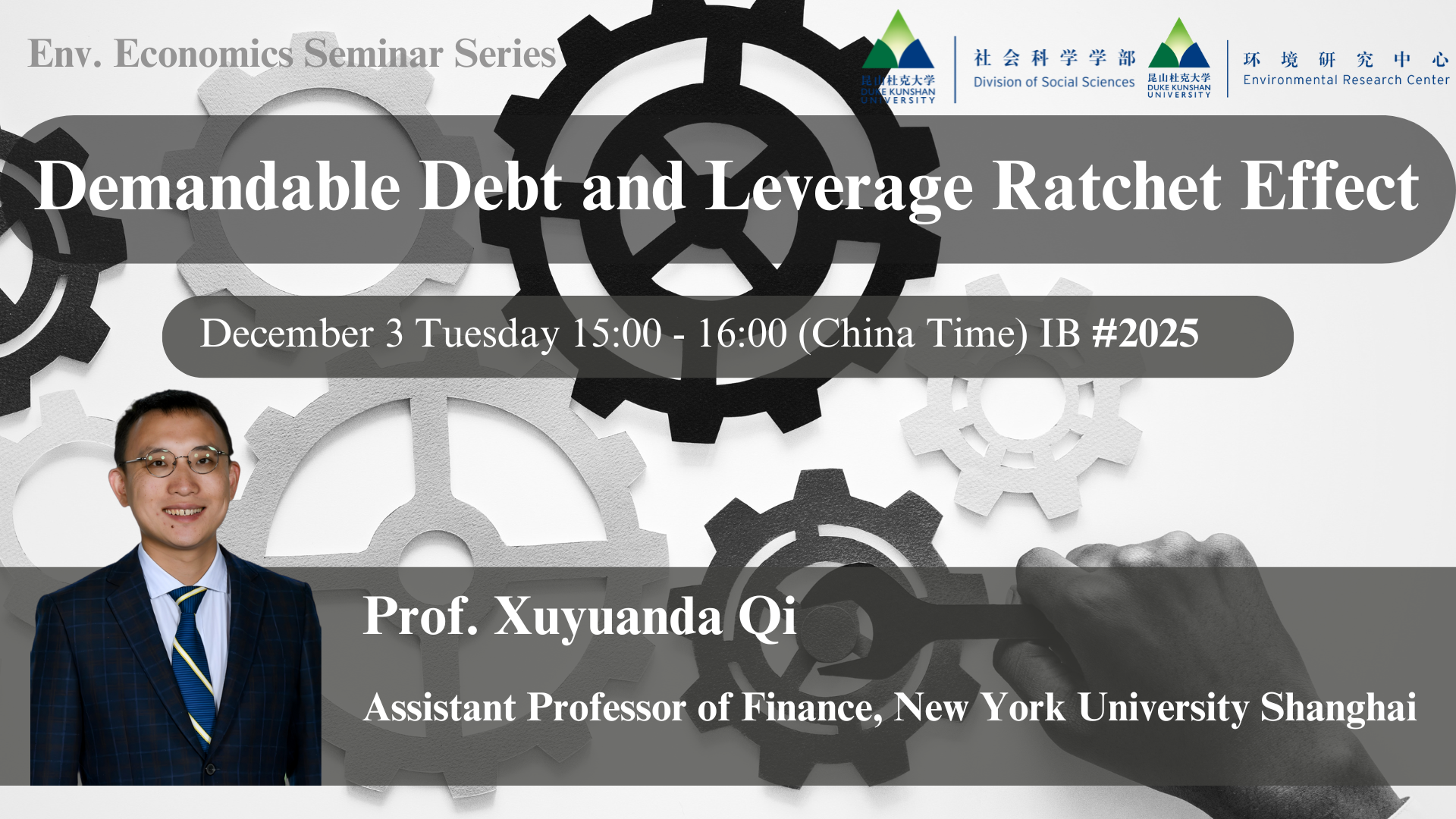

Env. Econ Seminar Series | Demandable Debt and Leverage Ratchet Effect

Speaker’s bio: Xuyuanda Qi is an Assistant Professor of Finance at NYU Shanghai. Prior to joining NYU Shanghai, he was a PhD candidate at the Simon Business School, University of Rochester. He holds a PhD from the University of Rochester, a MA from Columbia University, and a BEcon from Zhejiang University.Qi conducts research on theoretical corporate finance. He is also interested in venture capital, decentralized finance, and mechanism design.

Abstract: In this paper, we demonstrate that demandable debt provides an effective solution to the leverage ratchet effect without requiring any additional information beyond that assumed in the existing literature. Demandable debt-holders have an option to request full repayment of debt at any time. If the firm’s leverage exceeds its target debt ratio, debt-holders will exercise their option and sell this excess debt back to the firm. This mechanism efficiently disciplines the firm to maintain the target debt ratio, except under extreme negative shocks leading to inevitable bankruptcy. Furthermore, we show that as the model’s time intervals shorten, the firm can asymptotically achieve the full tax shield benefits without incurring any bankruptcy risk.

To register for this event email your details to shuqian.xu@dukekunshan.edu.cn

Date And Time

2024-12-03 @ 04:00 PM