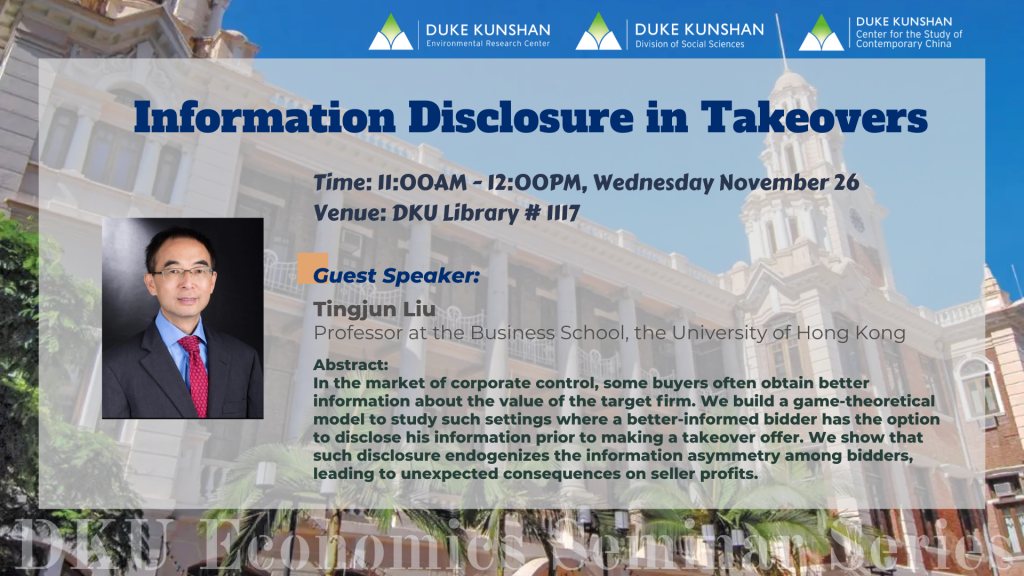

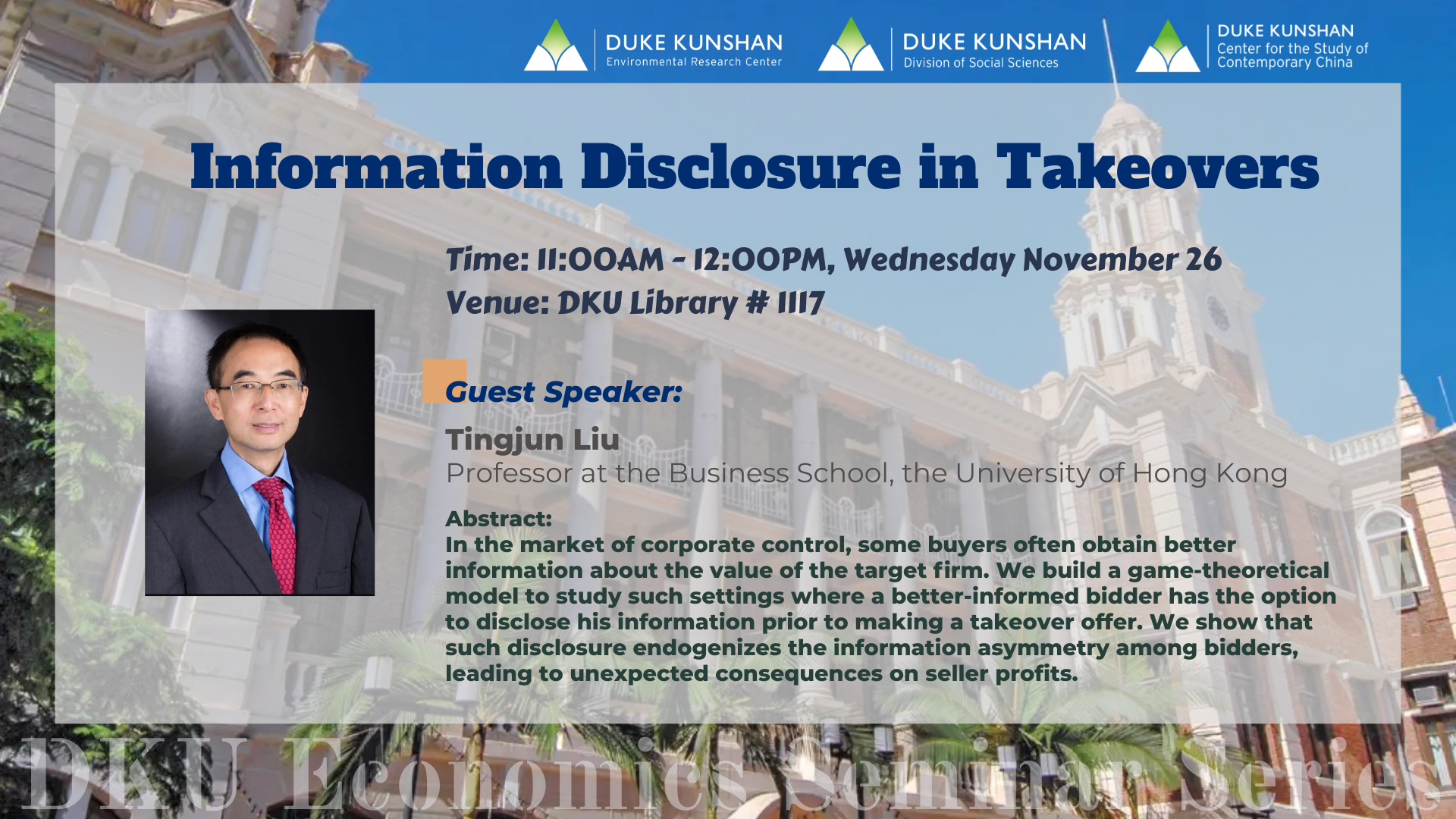

Information Disclosure in Takeovers

Abstract: In the market of corporate control, some buyers often obtain better information about the value of the target firm. We build a game-theoretical model to study such settings where a better-informed bidder has the option to disclose his information prior to making a takeover offer. We show that such disclosure endogenizes the information asymmetry among bidders, leading to unexpected consequences on seller profits.

Bio: Prof. Tingjun Liu received his Ph.D. in Financial Economics from Carnegie Mellon University in 2007. He also holds a B.S. in Physics from Peking University, and a Ph.D. in Physics from the University of Virginia. Prior to joining The University of Hong Kong, Tingjun taught at Renmin University of China and Cheung Kong Graduate School of Business.

Tingjun’s research interests include information economics, theoretical corporate finance, mergers and acquisitions, and auction theory. He has published extensively at leading journals including Accounting Review, Econometrica, American Economic Review, Journal of Economic Theory, Journal of Finance, Review of Financial Studies, Journal of Financial Economics and Management Science. He received Outstanding Researcher Award at Hong Kong University Business School in 2022. Externally he serves on the program committees of international conferences including European Finance Association meetings and Western Finance Association meetings.

To register for this event email your details to shuqian.xu@dukekunshan.edu.cn

Date And Time

2025-11-26 @ 12:00 PM